Limitations of the traditional financial system lead to the creation of cryptocurrency and the launch of Bitcoin in 2009. Blockchain based financial instruments are the result of a natural evolution of how humans manage their finances. Innovation which happened in the private sector is now being deployed by governments.

The EU, the USA, the UK, Japanese, Indian and Russian central banks are researching the possible use of blockchain technology and the use of the central bank digital currency (CBDC). China is leading the path with its own digital yuan and is already performing extensive public testing. China is more advanced in digitalization of its economy and China’s digital yuan can be a great case study for the EU and other countries.

What is Digital Yuan (e-CNY)?

Digital yuan is also called e-CNY, e-Yuan, digital RMB, e-RMB or Yuan Cryptocurrency. Digital Renminbi is the official digital currency of China which relies on some aspects of blockchain technology to facilitate and verify transactions. However, unlike Bitcoin, it is a centralized currency and issued by China’s central bank, the People’s Bank of China (PBOC). It is already a legal tender in the country and has an equal value with traditional Chinese yuan.

In 2016 a deputy governor of the PBOC, Fan Yifei, said that “the conditions are ripe for digital currencies, which can reduce operating costs, increase efficiency and enable a wide range of new applications”.

Key features of digital yuan (e-CNY):

- No intermediaries. It cuts out intermediation of banks between transactions, fewer middlemen may mean more efficient transactions. That’s possible due to the use of blockchain technology.

- Better privacy protection from third, non-governmental parties.

- Higher level government control. Central government has more insight and control over the use of money. For example, the government can directly provide money that can only be spent on certain goods.

- No interest can be paid on e-CNY.

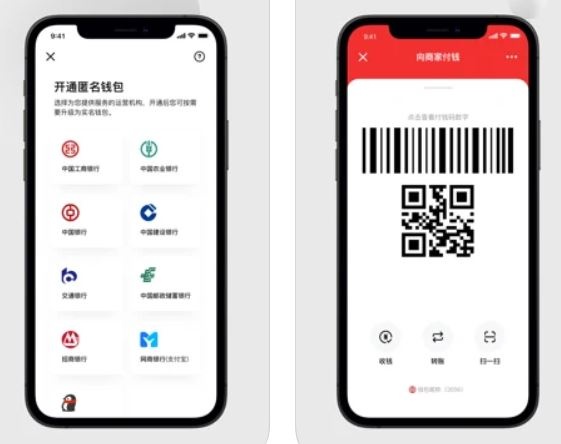

- No bank account needed. The PBOC’s pilot programs so far require only a mobile phone number to have an e-CNY digital wallet.

- Offline transactions. It is especially relevant for rural areas which has limited access to internet and banking services.

Digital RMB on iPhone

A large population of China has already adopted cashless payment options like WeChat pay and Alipay. The digital yuan can integrate with these pre-existing systems, leading to mass adoption by the public relatively quickly.

Technology behind e-CNY

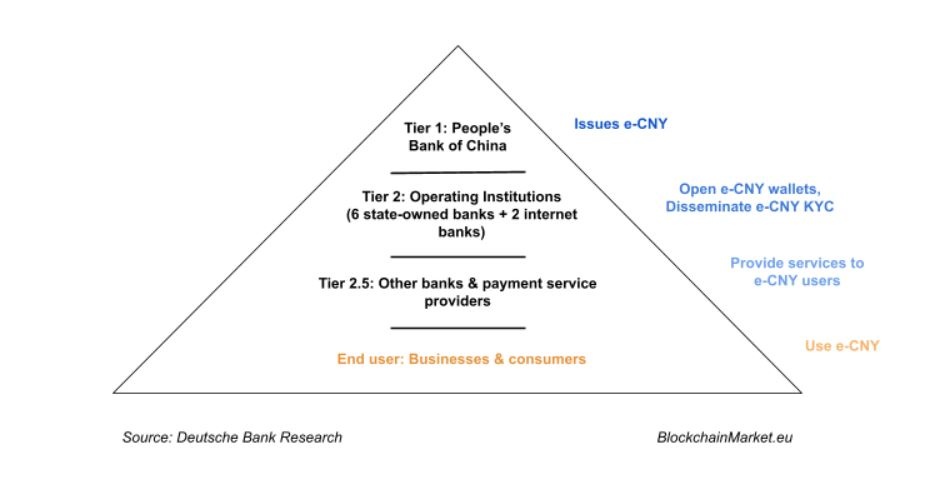

China’s new digital money is based on cryptography and is using some aspects of blockchain technology. The centralized nature of digital yuan allows the government to have extensive control over its currency. The administration of digital yuan combines traditional monetary controls and blockchain enabled solutions.

The PBOC is planning to maintain three data centers to ensure smooth operation of its currency:

- Registration center. Processing of transactions on a blockchain.

- Authentication center. KYC system, managing user identities.

- Big data center. Payment behaviour & other data analysis.

The payments with digital RMB can be done online and offline due the use of NFC (near-field communication). This allows transfers of money between different devices which is a similar way to Apple Pay and Samsung Pay to conduct electronic transactions. There is also a plan to roll-out hardware wallets which can be used offline as well.

Digital RMB & Super Apps: WeChat, Alipay

One of the greatest advantages of China’s digital currency is that it will be launched on widely used so-called supper apps – WeChat and Alipay. 90% of all mobile payments are done via these apps and they provide 360 coverage of financial services. EU citizens don’t have such financial applications in their disposal, therefore we can expect a slightly different infrastructure for digital Euro.

When Chinese use WeChat or Alipay to make payments with traditional yuan then it is done via QR code which connects different banking accounts. So ultimately the money is stored in bank accounts and mobile payment apps are just used as a proxy.

However, in the case of digital yuan the money is being transferred between different wallets and not banking accounts. Intermediation of banks is removed. This is very similar to the way Bitcoin and Ethereum works. If the e-CNY wallet is stored on the mobile phone then the money is transferred from one mobile wallet to another mobile wallet without intermediary, without needing a bank to verify the transaction. This is possible because of blockchain technology. WeChat and Alipay are going to be used as digital wallets for blockchain based digital currency.

Bitcoin (BTC) vs Digital Yuan (e-CNY)

The development of cryptocurrencies such as Bitcoin enabled the development of the digital yuan. Bitcoin opened the doors for blockchain based currencies. Bitcoin popularized the concept of cryptographic, blockchain currency and provided a blueprint for further technological developments in the financial field.

Digital yuan similary to Bitcoin, relies on blockchain technology to facilitate and verify transactions, but one of the crucial differences is that e-CNY is centralized, government backed currency. Bitcoin is decentralized money which doesn’t need government involvement in order to exist or to be transacted. Both centralization and decentralization have their own advantages and disadvantages.

One of the advantages of digital centralized currency is that the infrastructure needed for the digital currency economy is being built and used in an organized and synchronized way. For example, PBOC is planning to maintain 3 data centers and is working closely with banks and online payment platforms to ensure smooth operations.

On the other hand, centralized currencies and people who hold these currencies are highly dependent on the government. Central banks can manipulate its currency (e.g. inflation) in order to achieve goals which might be not in the interests of the population. Blockchain based, centralized currency might provide an extensive power to the government to control the money. For example, it can become easier for a central bank to just “switch off” specific accounts if officials decide to do so for political reasons. This can strengthen digital authoritarianism.

e-CNY | BTC | |

Control |

|

|

Inflation |

|

|

Useage |

|

|

Infrastructure |

|

|

Backed by |

|

|

Will digital yuan have an impact on Bitcoin price?

It is likely that the adoption of e-CNY will not have a major impact on the cryptocurrency market in the short-term, because China has already banned non-government cryptocurrencies, including Bitcoin. On the other hand, digital yuan can further popularize the concept of crypto money technology which could result in a wider adoption of cryptocurrencies in a long-term. In this case cryptocurrencies (centralized and decentralized) can become the default money, thus Bitcoin can become a global independent alternative to e-CNY and other CBDCs.

Why Does China Need Digital Yuan?

Digital yuan will allow a higher level of government control and oversight of transactions and capital flows. By combining this with big data and artificial intelligence (AI) it can open gates for groundbreaking solutions in managing country’s finances. This can, among many other things, allow more efficient capital distribution in the society and further spur economic growth.

Digitalization of China’s economy had a great impact on China’s GDP growth and lifted many people out of poverty. Alipay and WeChat made financial operations more smooth and more easily accessible for regular citizens. However, traditional yuan on Alipay and WeChat apps doesn’t allow offline transactions and requires the availability of an active bank account to use money. This is a significant barrier to financial inclusion, because in December 2020, the internet penetration rate in rural areas in the country was only 55.9 percent.

That is not the case with digital yuan, it only needs a registered mobile phone number. People can transact even if they’re not connected to the internet, simply by tapping two digital-yuan-enabled phones together. Further digitalization of the money system by introducing e-CNY can mean that huge numbers of people living in rural areas can be included into the economy and have access to various financial services.

This has also an impact on privacy in China. Though e-CNY allows more government control, but it protects user anonymity from such actors as online platforms and individual government institutions. According to China Chief Economist, Yi Xiong, the e-CNY gives its users the option to hide their identity from counterparties, while allowing law enforcement to have the ability to trace illegal transactions. e-CNY’s anonymity feature will make it more difficult for online platforms to collect user information.

The digital nature of the currency enables the government to follow money trails and prevent counterfeiting, financing of terrorist or criminal activities. Of course it can be also used to suppress financing of anti-government movements.

China’s CBDC might also have an international and geopolitical impact. Digital yuan can attract international users due to its ease of use and no third-party currency requirements. For example, this type of currency which requires only a mobile phone might be attractive to the huge rural population in African countries. M-Pesa, a mobile phone-based money transfer service, is already very popular in Kenya. In other words, there is already a fertile ground for the adoption of digital currency.

The use of digital yuan can spread to other countries which trade actively with China (such as Germany) and this might allow the Chinese government to have some political-financial leverage in those countries through the use of its crypto yuan.

All in all, digital yuan can serve as a tool to spur a country’s economy, to prevent criminal and anti-governmental activities, and be used in geopolitical competition.

International Implications of Digital Yuan

The digital yuan is paving the way for CBDCs to be issued all over the world. The EU is actively investigating possibilities of digital euro and the potential upcoming release of the European CBDC can be seen as a response to the digital yuan. The USA is also looking into developing their own digital dollar. If the Chinese currency gains traction, many other countries may follow and introduce their digital currencies, ushering in an era of Central Bank Digital Currencies and this can revolutionize the global financial system.

The rise and potential success of digital RMB can strengthen China’s economy, but it can also start challenging the US dollar. The trust in the US dollar is declining, but at the moment it is difficult to imagine that digital yuan can replace the US dollar as the global reserve currency. On the other hand, blockchain based currency can be more versatile and it can open new paths, new usage models and potentially create new rules for the financial markets. For example, China’s CBDC can potentially make it easier to make international transactions in developing or the US and the EU sanctioned countries. Therefore, it is possible to argue that digital yuan can start competing with the US dollar and the euro in an asymmetric way by avoiding traditional international financial infrastructure.

This new financial paradigm can open new possibilities for the EU and the euro. The adoption of blockchain based currency and combining it with AI in financial markets can lead to a more effective distribution of capital within the EU. CBDC can also diminish the role of commercial banks in Europe. By creating its own CBDC it can increase its independence from the US dollar and have a higher level of geopolitical autonomy. China & the EU belong to the same Euroasian continent and the new financial system and changed geopolitical situation can lead to a closer cooperation between these top economies.

Summary

Potential key implications of digital yuan and other CBDCs:

- transformation of global financial system;

- more efficient capital flows;

- increased state control.

Cryptocurrency technology can be seen as a natural evolution of money which opens a wide range of new financial possibilities. Central banks are adapting to the new innovations and China is paving the way by creating its own digital yuan. People’s Bank of China (PBOC) is combining features of traditional fiat currency and blockchain based currency in order to strengthen China’s economy and its positions in the international financial system. If digital yuan is a success then we can expect other central banks launching their own digital currencies (CBDCs) which might lead to a complete transformation of the financial system. This could mean more financial inclusion and more growth opportunities for the societies, on the other hand it is likely that due to CBDCs governments, including the EU, are going to have more control over population’s finances. The latter can result in a decrease of privacy and an increase in digital authoritarianism. The existence of Bitcoin and other decentralized financial instruments might become even more relevant in counterbalancing centralized power.

Resources:

- Cork University Business School – debate with Richard Turin who is an author of “Cashless – China’s Digital Currency Revolution”.

- Deutsche Bank – Digital yuan: what is it and how does it work?

- Quartz – China is combating crypto with a push for the digital yuan

- CNBC – China has given away millions in its digital yuan trials. This is how it works