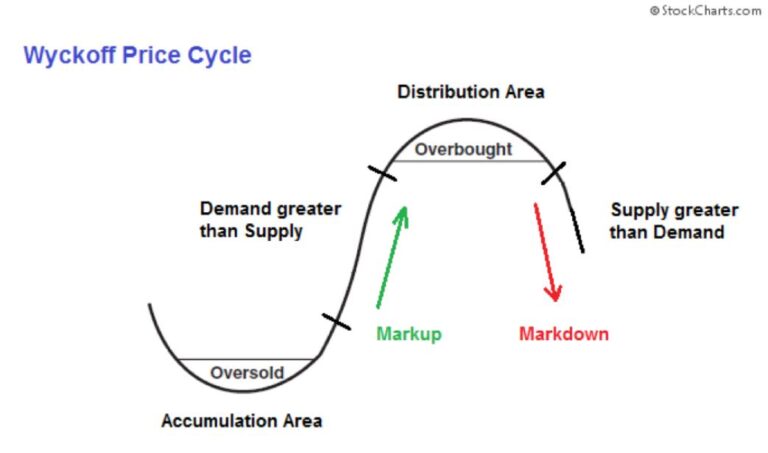

Market manipulation is nothing new. Around 100 years ago Richard D. Wyckoff (1873–1934), one of the biggest trailblazers in using technical analysis, concluded that stock prices were manipulated by bigger institutions and “whales” in their own favour. Today in traditional markets there are various regulations which try to address manipulation of prices, but the cryptocurrency market is still pretty much a wild wild West.

According to some crypto market analysts, such as Anders Larsson (CTO Larsson), it is very possible that the recent Bitcoin dump was predetermined by crypto whales who decided to play a game with regular people’s finances and just used a 100 years old Wyckoff method playbook.

Firstly, “the manipulators” come into the market to test the waters, then start pumping the price to get wider attention. More people come into the market with a hope to make a lot of money. Then there are series of dumps and pumps where crypto whales take out profits and then pump the market again to get more traders into the crazy carousel. When the market starts to show signs of exhaustion then whales take out massive profits and dump Bitcoin. This results that regular traders experience huge losses.

Of course there is no 100% proof that this theory is true, but knowing the history of market manipulations it is not surprising that these type of events happen in the crypto market which has a lot of gray areas.

What can we learn from this?

This potential Bitcoin manipulation and Wyckoff insights raises a question if crypto markets should be regulated more. How that regulation should look like it is something to think about. The blockchain market can potentially offer solutions, for example, by creating a global DAO (Decentralized Autonomous Organization), sort of a United Nations of crypto market, but which is based on principles of transparency, decentralization and democracy.

And the obvious lesson is: be very cautious and when investing do everything to manage the risks and stay in a winning position no matter what.

Below you can learn more about Richard D. Wyckoff.

Who was Richard D. Wyckoff?

Richard Demille Wyckoff (1873–1934) developed his own method of trading and investing in the financial markets (the Wyckoff method), according to which he entered into transactions on the exchange. The effectiveness of his method is evidenced by the fact that Wyckoff personally owned a mansion on nine and a half acres of land in the prestigious Great Neck, New York, next door to General Motors president Alfred Sloan.

As his wealth grew, Wyckoff became more altruistic, helping aspiring traders from the general public learn to trade and avoid losses. He dedicated himself to teaching the public about “the real rules of the game” as played by the big players, or “smart money.” In particular, starting in 1922, he wrote a column for The Saturday Evening Post, where he published articles of an educational and revealing nature, for example, “The Broker’s Kitchen and How to Avoid It.”

Developing as a trader and educator, Wyckoff has always been interested in the true logic behind price movements. Through conversations, interviews, and research into the operations of the successful traders of his day, Richard Wyckoff developed and documented the method he traded himself and taught to his students. Wyckoff collaborated with such personalities as Jesse Livermore, E. H. Harriman, James R. Keane, Otto Kahn, J. P. Morgan, and other major operators of the early 20th century.