Crypto Insurance: Bridge Mutual Vs Nexus Mutual

Technology, however secured, is susceptible to hacks. The same is true for one of the most secured technologies – blockchain.

The Ethereum DAO attack of 2016 shook the crypto universe losing millions worth of Ether (ETH). Such events, when coupled with a lack of awareness, prevent us from entering the cryptocurrency universe.

Huge amounts of wealth is being managed in the cryptocurrency universe everyday and many users have asked the question:

Can you freely navigate the cryptocurrency universe as your funds are insured?

Yes! Crypto insurance platforms like Nexus Mutual and Bridge Mutual have made this possible.

Keep reading, as this post covers everything about these decentralized insurance companies and how they are bringing a paradigm shift in the insurance landscape.

Nexus Mutual vs Bridge Mutual – A Detailed Comparison

| Category | Nexus Mutual | Bridge Mutual |

| Insurance Cover |

|

|

| Network | Ethereum | Polkadot |

| Company Structure | Registered decentralized mutual | Entirely on-chain, decentralized mutual |

| Token | Nexus Mutual Token (NXM token) | Bridge Mutual Token (BMI token) |

| Token Exchange Listing | None (NXM tokens are only available on the Nexus Mutual platform) | Uniswap, 1inchExchange among others |

| Token Holder Roles |

|

|

| Token Price Model | Dependent on the organization’s health | Dependent on supply and demand |

| Stakeholder Return | ● Up to 50% of premiums ● Voting rewards | ● 20% of premiums ● Constant yields from reinvestment of coverage funds ● Voting rewards |

| Accepted Cryptocurrencies | ETH, DAI and NXM | ETH, DOT, BMI and USDT |

| KYC Requirements | Yes | No |

| Cover Price Model | The cover price depends on –

| The cover price is calculated using a Dynamic Pricing Model that considers the risk factors of the asset. |

| Claim Voting Process | Multiple phase voting | ● Smart contracts – 3 phase voting ● Stablecoins – No voting; stablecoin claims are automatically settled. |

Discretionary Mutual Vs. Insurance

Before we dive into the world of decentralized insurance, let’s first understand the nuances.

Under a traditional insurance policy, you have the contractual right to get your coverage amount from the central insurance authority if the conditions are met. However, insurance has arguably become too much profit-driven affair involving premiums, fines, etc.

Nexus Mutual and Bridge Mutual have adopted a different approach where insurance covers are provided by the users, for the users, thanks to the decentralized aspect of blockchain tech. There is no central company exploiting users for profits. These companies are built on blockchain platforms where users pool funds to cover each other. This model is called a discretionary mutual where the protected individuals have the right to have their claim considered. Under this ecosystem, users stake funds to back the blockchain asset (smart contracts, exchanges) for an incentive. In case of hacks or losses, the staked funds are used to pay out the claim.

What is Nexus Mutual?

Nexus Mutual is an Ethereum-based discretionary mutual that currently offers insurance against blockchain risks such as exchange hacks and smart contract failures. For this, the company has created a community-driven mutual (risk-sharing) pool where member-staked NXM (Nexus Mutual tokens) units are used to pay out coverage claims.

Nexus Mutual was established in 2017 by Hugh Carp. The company is registered in the UK as a company limited by guarantee and has the approval of the Financial Conduct Authority (Bank of England) to use the word ‘mutual’. As of this writing, Nexus Mutual has around $300 million in total value locked (TVL).

Nexus Mutual currently offers:

- Smart Contract Cover

This cover expands to all smart contract addresses on the Ethereum blockchain, given the cover has enough amount staked. It covers major decentralized finance (DeFi) protocols, including Compound, Uniswap, Maker, Curve, and Aave, 1inch.exchange, yEarn Finance, Opyn, to name a few.

- Centralized Exchanges Cover

Nexus Mutual covers centralized exchange big shots like Coinbase, Binance, Kraken, and Gemini. Under this cover, you are insured against hacks and halts in withdrawal.

Are you wondering – Have Nexus Mutual ever paid out claims?

Yes! In the bZx flash loan case in February 2020, Nexus Mutual disbursed $34,996 to three members.

To buy Nexus Mutual’s decentralized insurance or cover for centralized exchanges, you have to become a member by depositing 0.002 ETH and completing the KYC requirements. You can buy the cover using ETH, NXM (Nexus Mutual tokens), or DAI tokens via a Metamask account.

NXM Tokenomics

NXM is an ERC-20 token native to Nexus Mutual. The platform is run by members holding NXM tokens. You can buy NXM tokens only on the Nexus Mutual platform, and the tokens can only be transferred among Nexus Mutual members. However, you can buy wrapped NXM (wNXM) tokens from exchanges like Uniswap and Binance to indirectly benefit from the project without having to participate in it. As of this writing, each NXM token is priced around $60.

Nexus Mutual follows a continuous token model, meaning that the price of the token is dependent on how the mutual performs. In simple words, the price of NXM tokens surges when the mutual has sufficient capital and decreases in the case of lesser funds in the pool.

How Does Nexus Mutual Work?

Nexus Mutual is a Decentralized Autonomous Organization (DAO) totally owned and governed by the members. The members decide which smart contract to back, which claims are legitimate, and they have a role in governance.

In theory anyone can become a Nexus Mutual member and participate in its governance. Unfortunately, the membership is restricted due to laws and regulations in some specific countries. Interestingly, in the list of restricted countries is one EU member, which is Germany.

NXM Membership

Apart from the members, there are five advisory board members who are experts in smart contract security, insurance, and mutuals, as well as legal and regulatory matters.

Members who stake NXM tokens can participate in:

- Risk Assessment

Risk Assessors stake a certain amount of NXM tokens against smart contracts. The coverage claim is paid out from this staked pool. Say a Risk Assessor has NXM tokens backing a smart contract ‘A’. If there is a breach in A, the tokens staked by the assessor will be used to pay out claims. Risk Assessors earn up to 50% of the premiums if they back safe contracts.

- Claim Assessment

Members who stake NXM tokens for assessing claims vote a yes/no to the claim made by the user. These claim Assessors are financially incentivized for voting in the long-term view. Also, their stake will be burned in case of voting for fraudulent claims.

- Governance

As a Nexus Mutual member, you can also recommend changes to the protocol via a proposal. Voting rewards are distributed to the members who vote irrespective of their token holdings.

What is Bridge Mutual?

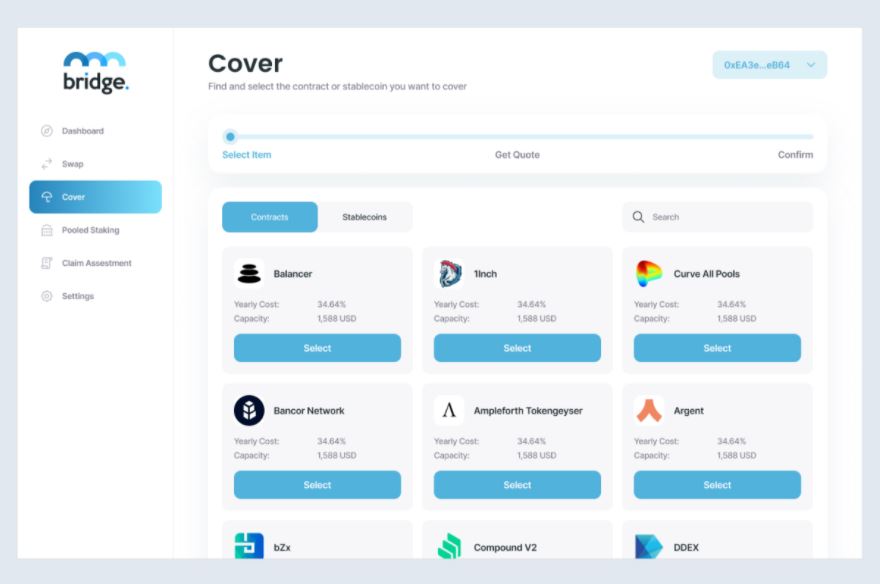

Bridge Mutual is a discretionary mutual that offers decentralized insurance coverage for losses from hacks or vulnerabilities in smart contracts, cryptocurrency exchanges, and stablecoins. The Bridge ecosystem is built on the Polkadot network.

The platform is governed by its native BMI token-holders. BMI token holders provide coverage, decide on claim payouts, and take part in the platform’s governance. You can also become an insurer by staking a certain amount of BMI tokens and earn – a) constant yields obtained from the reinvestment of coverage funds and b) profits made by premiums. Nevertheless, if you back less secured assets, your BMI stake will be used to cover the claim.

Anyone and everyone can participate in Bridge Mutual’s platform. To purchase a cover, you need to:

- Choose an asset.

- Set the number of days and the amount of coverage required.

Once you have set these fields, the Bridge system will generate a quoted fee called ‘premium’. To proceed with the cover, you have to pay the quoted amount using BMI, USDT, DOT, or ETH. Bridge does not require KYC details to buy insurance covers.

Moreover, to submit your insurance claim you have to submit appropriate information and evidence on the Bridge Mutual’s platform. Stablecoin claims are automatically and immediately processed. On the contrary, smart contract and exchange coverage claims go through a multi-phase voting process before your claim is approved and settled.

BMI token holders vote on your claim, where each token counts for a vote. This voting mechanism is a three-phase process with incentive and punitive measures in place to maintain the integrity of the process. The users who vote in the majority are rewarded with BMI tokens, while the users who vote in the minority will have their BMI stake burned depending on the discrepancy. Also, for close voting calls (for example, 55% to 45%), the minority voters won’t be punished.

Furthermore, you have the right to appeal if your claim is not approved. In this case, your claim will be handled by ‘Trusted Voters.’

You can earn BMI tokens by:

- Proving convergence to stablecoins

- Staking BMI tokens

- Honestly voting on claims.

You can buy BMI tokens on Uniswap, 1inchExchnange, and other popular exchanges. BMI tokens are currently priced above $2 per unit.

Two platforms for different type of users

Nexus Mutual and Bridge Mutual, both of these decentralized insurance platforms, are providing an extra layer of security to the cryptocurrency and the DeFi universe and, as a result, encourage more users to participate without having to worry about smart contract failures, hacks, etc.

Nexus Mutual has two products, whereas Bridge provides an extra cover for stablecoins. The former offers up to 50% earnings on premiums while the latter provides 20% on premiums, plus yields from the investment of coverage funds. Also, Bridge doesn’t require KYC documents.

Each of these crypto insurance appeals to a different set of users. Analyze your needs and accordingly choose a platform.