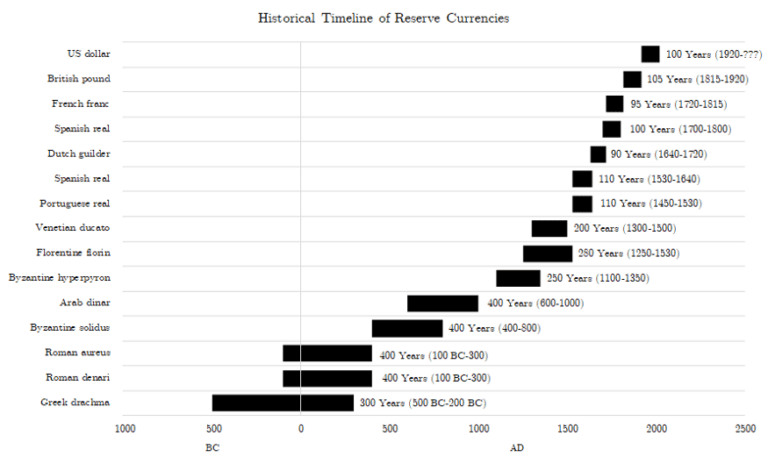

The US dollar has been a reserve currency for 102 years. The British pound lasted as a reserve currency for 105 years, French franc for 95 years, Spanish real for 110 years. We see that in modern human history the dominance of one currency lasted for about 100 years.

In 2020-2021 we witnessed “printing” of the USA dollar on an unprecedented scale. Many financial experts are warning that this is unsustainable and it can lead to the demise of the US dollar. This can create conditions for the emergence of a new global reserve currency. On the other hand, it is also possible that there is going to be a reset of the economy and the new reformed US dollar is going to emerge, perhaps in the form of the digital dollar – Central Bank Digital Currency (CBDC).

Geopolitical situation is also changing and the USA is facing an increased challenge from China. The US dollar for a long time was one of the key instruments of power. It is possible that China has a plan on how to reduce the influence of the US dollar and one of the ways to do it is by re-inventing the money system itself. This could be done by the release of Chinese CBDC – digital yuan. During the winter Olympics 2022 digital yuan was used as a main payment method in the Beijing National Stadium. It replaced Visa payments as a main method of transactions for the first time in Olympic history. Central bank digital currencies such as eCNY allows more functionality and it is potentially more efficient than traditional currencies which are built on arguably outdated financial infrastructure. It is important to note that CBDCs are inspired by Bitcoin and blockchain technology.

Bitcoin itself can be seen as a challenge to the US dollar. For example, El Salvador adopted Bitcoin as official tender which allows El Salvador to circumvent the US dollar hegemony. Interestingly, IMF tries to put pressure on El Salvador to change its policy. Arguably, IMF is heavily influenced by the US interest groups. If the IMF and USA pressure is going to get weaker it might result in other countries adopting Bitcoin.

During the rising tensions between the US and Russia regarding Ukraine, the US threatened to cut off Russia from international payments system Swift. During this period Russia passed laws which acknowledged Bitcoin and other cryptocurrencies as a currency. This is a major step. This can help Russia to avoid imposed sanctions by Americans. Bitcoin has a chance to shine as a censorship and sanctions resistant currency, but it is also possible that the US friendly media might start a campaign against Bitcoin to push its price down and it might tarnish its reputation in the West.

In theory, politically neutral currency is good for business worldwide, because it provides stability and clearity. It is also a more democratic approach to global finances because it is not dependent on one country. There is a possibility that geopolitical competition might push Bitcoin into being as a global reserve currency, because of its neutral nature.

Bitcoin can also have unintended geopolitical consequences as well. Currency is often used as a political tool and if governments lose an ability to manipulate currencies in order to achieve political goals then governments might use other tools at their disposal which could also be military power. When the political power has decreased ability to use soft power (currency) it might resolve to using hard power such as a military.

It is hard to predict how the world’s financial system is going to look in the future. But it is getting clear that the future finances are going to be influenced by Bitcoin and blockchain technology. Learnings from decentralized finance (DeFi) is going to be applied in mainstream finances, China has already launched its own Bitcoin inspired digital yuan and digital euro with digital dollar are also being researched and might be deployed in the coming 10 years. Even if Bitcoin is not going to be a global reserve currency it can play a role as an alternative asset and as an instrument in geopolitical competition.